Cook County short on revenue, reconsiders sugary drinks

Rows of Coca-Cola 12 cases line the shelves of Jewel Osco. Coca Cola held a consolidated income of 7,366 million in 2015 according to the Coca Cola Company Reports.

The sound of expanding hardwood floor permeates through the silent classroom. Mr. Vlahos finishes drawing on the whiteboard and turns to face his students; the class is AP Microeconomics, and the lesson being taught is on elasticity.

“30 million versus 7.5 million in total revenue,” Vlahos says as he points towards the two graphs behind him. “So when should the government generally place a tax on a good?”

The class responds in unison to Mr. Vlahos’ query: “When the good is considered inelastic.”

According to Mr. Vlahos, inelastic goods are considered “necessities, whereby consumers will only slightly change their consumption of a good or service in response to a change in price. ”

Vlahos said that goods like water, medicine, and food fall under the category of inelastic because there are situations which make them necessary to live.

However, Vlahos also said that goods can be inelastic if they “have become indispensable for contemporary American life.”

Soda, sweet tea, and many sugar sweetened beverages (SSB) arguably fit into this category, due to the fact that in 2014, 64.5 percent of males ages 2-19 and 61.3 percent of females of the same age drank at least one sugary beverage a day, according the National Center of Health Statistics.

The large quantity of sugar consumption has led to recent taxations across the United States.

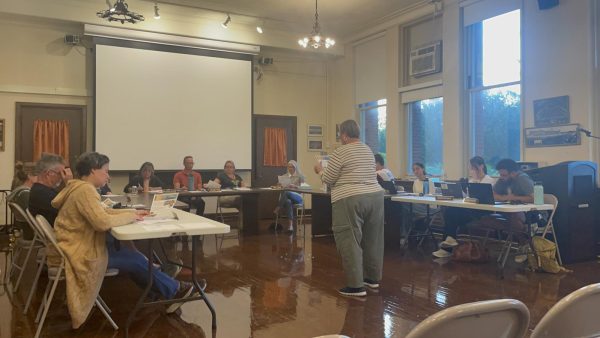

On November 10, 2016, Cook County Board President Toni Preckwinkle served as the tie breaking vote to pass a sugar sweetened beverage (SSB) tax of a penny per ounce. The excise tax is expected to decrease the amount of sugar-sweetened drinks consumed by the citizens of Cook County and generate a yearly $74.6 million in revenue, according to the Cook County 2017 Revenue Estimate (FY17).

“I don’t agree with it,” said Oscar Arroya, Manager of the Wicker Park Jewel Osco. “It seems to be another tax that would add to the cost of living.”

Before the SSB tax was passed, Arroya said that there were efforts to warn customers of the tax, which varied from signs on the doors to tags on the aisle shelves, indicating the amount of money that the excise tax would add to the product. However, Arroya said that at the end of most shifts they would find the tags scattered on the ground of the sales floor. Now that the tax has been passed, customers are starting to ask more about it, Arroya said.

Frank Shuftan, Director of Communications under Toni Preckwinkle, said that the tax was passed because of two reasons: “Need and benefit.”

“There was a clear gap in the budget that needed to be filled,” Shuftan said, in a phone interview, in reference to the $174 million hole in the Cook County budget. “The Chief Financial Officer felt this gap could be reduced by the initiation of this tax.”

In terms of benefit, Shuftan said that large sums of money are spent by Cook County hospitals to help treat the very health problems associated with drinking soda (ie. hypertension, heart disease, obesity, etc.). The Cook County Health Enterprise Fund, which contains of the Department of Public Health and various other hospitals and organizations, will receive benefits of the gap closing through subsidies and estimated revenue from the FY17, Shuftan said.

Toward the end of the interview, Shuftan talked about the stance soda companies held against the tax during the early stages of the ruling.

“It is important to consider that those companies produce many non-sweetened beverages, as well as water,” Shuftan said. “The tax won’t stop people from drinking liquids entirely.”

From a statistical standpoint, previously initiated SSB taxes from across the world have produced results to support the County Board’s decision.

According to a study conducted by AJPH, a publication of the American Public Health Association, the consumption of SSBs decreased by 21 percent in Berkeley, California after the jurisdiction passed the first SSB tax in the United States. The study also presented the success of sugar taxes in both Mexico (decrease in consumption of 12 percent) and France (decrease in consumption of 6.7 percent).

In addition to following the recent accomplishments of various SSB taxes, the Cook County Board’s ruling came at a time when 19 percent of Chicago Public School kids have been determined “obese,” according to the Chicago Department of Health’s Healthy Chicago 2.0 plan.

Statistics like these could loom heavily over a school like Lane Tech: Being surrounded by over a dozen storefronts who distribute SSBs regularly.

A recent survey of 76 students of Lane classes showed that 73.7 percent of those surveyed drink at least one soda a week: 44.6 percent of whom reported drinking 3 or more times per week. The survey also showed that 20.8 percent of the respondents would be more inclined to bring soda into school if it weren’t prohibited: evidence of a desire for soda which is primarily what the Cook County Board hopes to deter.

Students leaving Mr. Vlahos’ economics class, headed to the storefront windows lined with soda, will have to get use to the idea that soda will cost more now. An additional $0.12 per soda can will be put into law starting July 2017.

Your donations directly fund the Lane Tech student journalism program—covering essential costs like website hosting and technology not supported by our school or district. Your generosity empowers our student reporters to investigate, write, and publish impactful stories that matter to our school community.

This website is more than a publishing platform—it's an archive, a research tool, and a source of truth. Every dollar helps us preserve and grow this resource so future students can learn from and build on the work being done today.

Thank you for supporting the next generation of journalists at Lane Tech College Prep!

Tommy is a senior who loves to write both prose fiction and playscripts. He is the editor of Lane Tech’s Key Club and the president/founder of Lane’s...

James Coyne started Journalism in his sophomore year and became the Photo Editor his senior year. He has focused most of his work towards the feature...