Questions raised over consumer education curriculum

December 27, 2017

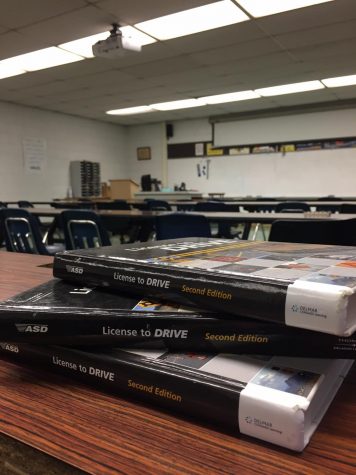

Lane’s current Driver’s Ed textbooks that contain a chapter about car maintenance and car buying. Students attain their consumer education graduation requirement through the Drivers Education course.

Graduating leads students into a world of independence, which can be intimidating. When students don’t know how to deal with certain “adult” things like personal budgeting, balancing a checkbook, and figuring out their 401K, the world becomes increasingly more complicated and scary.

Consumer education, which teaches students about certain topics that will come into effect when they are adults, is a required credit for all high schoolers in order to graduate in Illinois. That credit is acquired through learning about the subject for nine weeks, 50 minutes per school day.

Mr. Hoof, a counselor, said that at Lane, students attain the credit through Driver’s Education class.

However, Lane’s Driver’s Ed teachers, Ms. Onken and Mr. Mitchell, both said that students aren’t given the necessary information that should be provided to them through Lane’s consumer ed curriculum. The extent of the curriculum only relates to cars.

“I don’t feel at all that I get the opportunity to really talk about consumer ed,” Onken said. “I at least feel a little more confident that students have some idea about buying a car, what they should look for, or even just talking about insurance.”

Mitchell said that in 2008, Lane purchased new Driver’s Ed books, which contained a unit on car buying and car maintenance. Administration then decided that Driver’s Ed would be the class to take in which students would receive their consumer ed credit.

The Illinois State Board of Education defines consumer education as the advancement of students’ comprehension of topics required for everyday living. Their suggested curriculum includes goals such as becoming informed citizens, understanding the rights and responsibilities of consumers in society and developing a sound decision-making process based on individual goals and values.

Mr. Ara, an assistant principal, also said that he doesn’t understand why consumer ed is grouped in with Driver’s Ed.

“I would define [consumer ed] as what kids should know: real estate, taxes, banks, loans, these types of things,” Ara said. “[It] makes no sense for it to be in the Driver’s Education class. It should be more part of a social science curriculum.”

Hoof had also said that after AP testing, teachers may teach “life skill lessons.” Through certain electives such as economics, students may learn about topics such as property taxes or the stock market. These classes do not count towards the consumer ed credit, however.

Ara said, to the best of his knowledge, Lane has been meeting the requirement, but its curriculum has not been updated in the past few years.

According to the Council for Economic Education, only 20 states require students to take an economics course and 17 require students to take a personal finance course.

A 2015 statistic, found on the Council for Economic Education state survey study, showed that in Texas, Georgia and Idaho, the average credit score increased by an average of 12 points after they implemented financial education mandates in 2007.

Jazmin Guzman, Div. 969, expressed that she hasn’t learned enough through Lane’s current consumer ed curriculum that will allow her to be confident about certain aspects of life after graduation.

“Our whole life is going to be about buying thing,” Guzman said. “This is basically how you’re supposed to live as an adult. We are going to have to do these things, so why can’t we just learn about it earlier in life so when we have to do these things, it’s not difficult for us.”