Consumer education: A blueprint to adulthood

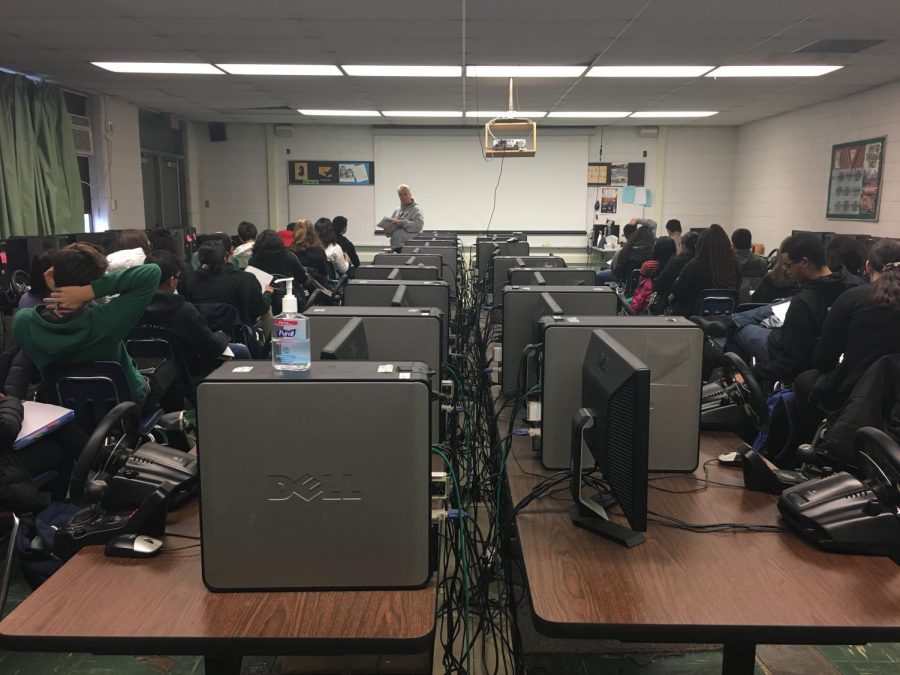

Driver’s education teacher Ms. Onken outlines the rubric for the annual car buying project, marking the start of the ‘consumer education’ curriculum for the students.

January 7, 2019

A large portion of a teenager’s high school education is focused on college and career readiness. With college, however, comes an independent lifestyle unknown to graduates taking on this new challenge.

Now, this imbalance in education has begun to change.

A survey by the Council for Economic Education dictates that the number of states in the U.S. that required a personal finance class in high school had grown from one to 17 in less than 20 years, indicating their increasing prevalence in the curriculum of high school students.

Additionally, a new mandate issued by CPS in May of last year outlines a new, semester-long course in which personal finances and budgeting are discussed more in depth. This goal of this new program is to ensure that “Chicago students and their parents have the knowledge, skills, and access to make informed personal financial decisions that lead to a future of financial empowerment,” as stated on the CPS website.

The Illinois State Board of Education (ISBE) defines consumer education as the general understanding of the role one has in business and government, as well as the basic duties of a consumer in society. The curriculum outlined by the ISBE indicates that the course may be comprised of financial literacy, state and federal taxes and personal insurance policies.

It is required by the ISBE that students from grades 9-12 receive some form of consumer education, whether it is joined with a supplemental class or standing as its own separate course.

The consumer education credit at Lane is integrated into the required driver’s education course sophomore year.

While the main focus of the driver’s education course is on the basic rules of the road, towards the end of the semester, driver’s education instructor Ms. Onken finds her own way to better incorporate the basis of consumer education.

Students are assigned the task of researching their ‘dream car’ and a car with a smaller budget. Additionally, they must find the best insurance for each car and determine personal payment plans for each, Onken said.

While she does feel that it is beneficial for students to understand budgeting and personal finances, she does not consider this short project a sufficient source of consumer education.

“Buying a car and buying insurance is not consumer education,” Onken said. “It’s a part of [consumer education], and it’s an important part, but there is so much more consumer education that needs to be taught.”

Onken suggested that the class could be taken as its own separate course during senior year; however, this may not be possible.

According to Assistant Principal Ms. Edwina Thompson, the consumer education curriculum does not cover enough material to fill the space of a semester class, let alone a year-long course. For this reason, the course material must be merged with a class of a different subject, such as financing.

Onken believes the course material associated with the class is better suited for an older age group as the class is currently taught sophomore year. The class would be more effective if taught as a senior year requirement, she said.

“When [students] are leaving school, after senior year, they may forget many of the skills they were taught two years prior,” Onken said. “Whereas in senior year, it is at the forefront of their minds and they get the chance to actually implement those practices probably within a few months of learning them.”

This situation is currently under revision as the administration is working towards finding a better place for the class, taking into account the requirements of the course as well as the age range during which the most knowledge may be retained by the student, according to Thompson.

Bernard Ucol, Div. 990, feels that another option for students who wish to be taught applicable life skills is Discrete Math/Business Stats, a course in which for half a semester, students focus on business statistics and the other half they cover order of data sets.

The class educates students on the critical thinking aspect that can be helpful in managing finances and budgeting, according to Ucol.

A survey conducted by the Gates Foundation concluded that roughly four out of every five high school dropouts wished that schools offered opportunities for learning real-world skills. Additionally, connections between schooling and the real world would have offered students an incentive to continue their educations.

“It’s a pretty vital idea, and I’d really appreciate it if more people offered it,” Ucol said. “It’s kind of weird that we’ll have classes where we can focus on our careers and our future, but none on how to maintain them.”